The BEST 2 listings near Pennsylvania, New Jersey and surrounding areas

The BEST 2 listings near Pennsylvania, New Jersey and surrounding areas

Legal Notices

SHERIFF'S SALE By virtue of a Writ of execution, to me directed, issued out of the SUPERIOR COURT OF NEW JERSEY CHANCERY DIVISION, CAMDEN COUNTY, DOCKET NO. F01042822 at Public Venue on WEDNESDAY the 15th Day of MAY, 2024 A.D. at 12 o'clock, LOCAL TIME, noon of said day, at 520 MARKET ST, CAMDEN, NJ 08102 CAMDEN CITY COUNCIL CHAMBERS ON 2ND FLOOR. The property to be sold is located in the TOWNSHIP of WINSLOW, in the County of CAMDEN and State of New Jersey. Commonly known as: 214 Cross Keys Road, Berlin, NJ 08009; Tax Lot No. 14, Block 115 Dimensions of Lot: (Approximately) 144.75 feet x 84.50 feet Nearest Cross Street: TURNERSVILLE ROAD The Sheriff hereby reserves the right to adjourn this sale without further notice by publication. SURPLUS MONEY: If after the sale and satisfaction of the mortgage debt, including costs and expenses, there remains any surplus money, the money will be deposited into the Superior Court Trust Fund and any person claiming the surplus, or any part thereof, may file a motion pursuant to Court Rules 4:64-3 and 4:57-2 stating the nature and extent of that person's claim and asking for an order directing payment of the surplus money. The Sheriff or other person conducting the sale will have information regarding the surplus, if any. This property is occupied by an unknown occupant. The estimated upset amount for the scheduled sheriff sale is currently $366 882.14. The upset price is not the same as a payoff or judgment redemption amount. T he judgment sought to be satisfied by the sale is: "APPROXIMATELY" $366,339.10 TWENTY PERCENT DEPOSIT REQUIRED Seized as the property of ROOSEVELT COLEY DECEASED, HIS/HER HEIRS, DEVISEES, AND PERSONAL REPRESENTATIVES, AND HIS, HER, THEIR OR ANY OF THEIR SUCCESSORS IN RIGHT, TITLE AND INTEREST, ET AL., defendant(s), and taken in execution of MORTGAGE ASSET MANAGEMENT, LLC, plaintiff GILBERT L. "Whip" WILSON SHERIFF Sheriff's Number: 24000748 DATED: 4/17, 4/24, 5/1, 5/8/2024 Attorney: KML LAW GROUP, PC MELLON INDEPENDENCE CENTER 701 MARKET STREET, SUITE 5000 PHILADELPHIA, PA 19106 MOUNT LAUREL, NJ 08054 Prt’s Fee:$114.24 Affidavit Fee:$5.00

You must Register or Login before you can email ad listings

Listed: Thu May 2nd

NMG Classifieds

Notices Legal Notices

NMG Classifieds

Notices Legal Notices

SHERIFF'S SALE By virtue of a Writ of execution, to me directed, issued out of the SUPERIOR COURT OF NEW JERSEY CHANCERY DIVISION, CAMDEN COUNTY, DOCKET NO. F01082823 at Public Venue on WEDNESDAY the 15th Day of MAY, 2024 At. at 12 o'clock, LOCAL TIME, noon of said day, at 520 MARKET ST, CAMDEN, NJ 08102 CAMDEN CITY COUNCIL CHAMBERS ON 2ND FLOOR. PROPERTY TO BE SOLD IS LOCATED IN: Gloucester City, County of Camden, in the State of New Jersey PREMISES COMMONLY KNOWN AS: 814 Somerset Street, Gloucester City, NJ 08030 TAX LOTS#5, 6&7, BLOCK#l52 APPROXIMATE DIMENSIONS: 55X 100 NEAREST CROSS STREET: Brown Street Upset price: $217,216.83 (Note, this is a good faith estimate of the upset price at sheriff’s sale that is being provided to you pursuant to N.J.S.A. 2A:50-64 (as amended)). It is not definitively known at this time whether the property is vacant, tenant occupied or owner-occupied. No representation is made regarding occupancy. * Also subject to subsequent taxes, water and sewer plus interest through date of payoff. SURPLUS MONEY: If after the sale and satisfaction of the mortgage debt, including costs and expenses, there remains any surplus money, the money will be deposited into the Superior Court Trust Fund and any person claiming the surplus, or any part thereof, may file a motion pursuant to Court Rules 4:64-3 and 4:57-2 stating the nature and extent of that person's claim and asking for an order directing payment of the surplus money. The Sheriff or other person conducting the sale will have information regarding the surplus, if any. THE SHERIFF HEREBY RESERVES THE RIGHT TO ADJOURN THIS SALE WITHOUT FURTHER NOTICE THROUGH PUBLICATION. A FULL LEGAL DESCRIPTION OF THE PREMISES CAN BE FOUND IN THE OFFICE OF THE SHERIFF OF CAMDEN COUNTY. The judgment sought to be satisfied by the sale is: "APPROXIMATELY" $215,837.64 TWENTY PERCENT DEPOSIT REQUIRED Seized as the property of RUTHANNE GREENE; SUSAN VITTORELLI, defendant( s), and taken in execution of U.S. BANK TRUST NATIONAL ASSOCIATION NOT IN ITS INDIVIDUAL CAPACITY BUT SOLELY AS OWNER TRUSTEE FOR RCF 2 ACQUISITION TRUST, plaintiff GILBERT L. "Whip" WILSON SHERIFF Sheriff's Number: 24000766 DATED: 4/17, 4/24, 5/1, 5/8/24 Attorney: PARKER MCCAY P.A. 9000 MlDLANTIC DRIVE, STE 300 P.O. BOX 5054 MT. LAUREL, NJ 08054 Prt’s Fee:$124.32 Affidavit Fee:$5.00

You must Register or Login before you can email ad listings

Listed: Thu May 2nd

NMG Classifieds

Notices Legal Notices

NMG Classifieds

Notices Legal Notices

SHERIFF'S SALE By virtue of a Writ of execution, to me directed, issued out of the SUPERIOR COURT OF NEW JERSEY CHANCERY DIVISION, CAMDEN COUNTY, DOCKET NO. F01106023 at Public Venue on WEDNESDAY the 15th Day of MAY, 2024 A.O. at 12 o'clock, LOCAL TIME, noon of said day, at 520 MARKET ST, CAMDEN, NJ 08102 CAMDEN CITY COUNCIL CHAMBERS ON 2ND FLOOR. The property to be sold is located in the BOROUGH of LAURAL SPRINGS, in the County of CAMDEN and State of New Jersey. Premises commonly known as: 1018 Chestnut Avenue; Block 8, Lot l Dimensions of Lot: (Approximately) 80' x 200' Nearest Cross Street: ALMOND AVENUE Cert No. 23-00007 must contact Borough of Laurel Springs Tax Collector for payoff. Approx Upset Price $163,850.00 (subject to change on day of sale) Property Status: Borrower Occupied Subject to any unpaid taxes, municipal liens or other charges, and any such taxes, charges, liens, insurance premiums or other advances made by Plaintiff prior to this sale. The amount due can be obtained from the local taxing authority. Pursuant to N.J.S.A. 46:8B-21 the sale may also be subject to the limited lien priority of any Condominium/ Homeowner Association liens which may exist. All interested parties are to conduct and rely upon their own independent investigation to ascertain whether or not any outstanding interest remain of record and/or have priority over the lien being foreclosed and, if so, the current amount due thereon. SURPLUS MONEY: If after the sale and satisfaction of the mortgage debt, including costs and expenses, there remains any surplus money, the money will be deposited into the Superior Court Trust Fund and any person claiming the surplus, or any part thereof, may file a motion pursuant to Court Rules 4:64-3 and 4:57-2 stating the nature and extent of that person’s claim and asking for an order directing payment of the surplus money. The Sheriff or other person conducting the sale will have information regarding the surplus, if any. The judgment sought to be satisfied by the sale is: "APPROXIMATELY" $165,012.56 TWENTY PERCENT DEPOSIT REQUIRED Seized as the property of KELLY A. KRAWCHUK, ET AL., defendant(s), and taken in execution of LAKEVIEW LOAN SERVICING, LLC, plaintiff GILBERT L. "Whip" WILSON SHERIFF Sheriff's Number: 24000791 DATED: 4/17, 4/24, 5/1, 5/8/2024 Attorney: MCCABE WEISBERG & CONWAY, LLC 216 HADDON AVE., STE 201 WESTMONT, NJ 08108 Prt’s Fee:$124.32 Affidavit Fee:$5.00

You must Register or Login before you can email ad listings

Listed: Thu May 2nd

NMG Classifieds

Notices Legal Notices

NMG Classifieds

Notices Legal Notices

SHERIFF'S SALE By virtue of a Writ of execution, to me directed, issued out of the SUPERIOR COURT OF NEW JERSEY CHANCERY DIVISION, CAMDEN COUNTY, DOCKET NO. F01393713 at Public Venue on WEDNESDAY the 15th Day of MAY, 2024 A.O. at 12 o'clock, LOCAL TIME, noon of said day, at 520 MARKET ST, CAMDEN, NJ 08102 CAMDEN CITY COUNCIL CHAMBERS ON 2ND FLOOR. The property to be sold is located in the municipality of TOWNSHIP OF GLOUCESTER in the County of CAMDEN and State of New Jersey. Commonly known as: 9 RADCLIFF COURT, SICKLERVILLE, NJ 08081 Tax Lot(s): 5, in Block: 18104 Dimensions (Approx.): 49 x 236 Nearest Cross Street: LANE OF ACRES Important: Indicate lien information, if any, to be advertised pursuant to the Supreme Court decision of 10/28/99- - Summit Bank vs. Dennis Thiel (A-58-98). Sheriff kindly advertise the following: Tax Certificate Recorded: April 22, 2013 Amount: $226.25 Book: 9790 Page: 104 Instrument Number: 12-04021 Tax Certificate Recorded: March 18, 2015 Amount: $268.23 Book: 10168 Page: 928 Instrument Number: 14-7358 - Occupancy Status: Owner Occupied - Good Faith Estimated Upset Price: $545,895.30, plus any additional sums entered by the court. Surplus Money: If after the sale and satisfaction of the mortgage debt, including costs and expenses, there remains any surplus money, the money will be deposited into the Superior Court Trust Fund and any person claiming the surplus, or any part thereof, may file a motion pursuant to Court Rules 4:64-3 and 4:57-2 stating the nature and extent of that person's claim and asking for an order directing payment of the surplus money. The Sheriff or other person conducting the sale will have information regarding the surplus, if any The judgment sought to be satisfied by the sale is: "APPROXIMATELY" $561,205.23 TWENTY PERCENT DEPOSIT REQUIRED Seized as the property of FRANK ROSSELL AND DONNA ROSSELL, HIS WIFE; MLG REAL TY LLC; UNITED STATES OF AMERICA; KENNEDY HEALTH SYSTEMS, defendant(s), and taken in execution of DLJ MORTGAGE CAPITAL, INC., plaintiff GILBERT L. "Whip" WILSON SHERIFF Sheriff's Number: 22001337 DATED: 4/17, 4/24, 5/1, 5/8/24 Attorney: FRIEDMAN VARTOLO LLP 1325 FRANKLIN AVENUE SUITE 160 GARDEN CITY NY 11530 Prt’s Fee:$115.92 Affidavit Fee:$5.00

You must Register or Login before you can email ad listings

Listed: Thu May 2nd

NMG Classifieds

Notices Legal Notices

NMG Classifieds

Notices Legal Notices

SHERIFF'S SALE By virtue of a Writ of execution, to me directed, issued out of the SUPERIOR COURT OF NEW JERSEY CHANCERY DIVISION, CAMDEN COUNTY, DOCKET NO. SWCF01117323 at Public Venue on WEDNESDAY the 15th Day of MAY, 2024 A.D. at 12 o'clock, LOCAL TIME, noon of said day, at 520 MARKET ST, CAMDEN, NJ 08102 CAMDEN CITY COUNCIL CHAMBERS ON 2ND FLOOR. All that certain tract or parcel of land and premises, situate, lying and being in the Township of Voorhees, County of Camden and State of New Jersey identified below: Commonly known as: 39 Lafayette Avenue, Voorhees, NJ 08043 Tax Lot 28, Block 270 (f/k/a Lot 2, Block 293) Dimensions {approx.): 2.594 AC Nearest Cross Street: Centre Avenue Amount Due for Taxes: SUBJECT TO ANY OPEN TAXES, WATER/SEWER, MUNICIPAL OR TAX LIENS THAT MAY BE DUE. THERE ARE TAX LIENS ON THE PROPERTY, THE AMOUNTS OF WHICH ARE PRESENTLY UNKNOWN. TAX AND PRIOR LIEN INFO: AT THE TIME OF PUBLICATION, TAXES/SEWER/WATER INFORMATION WAS NOT AVAILABLE - YOU MUST CHECK WITH THE TAX COLLECTOR FOR EXACT AMOUNTS DUE. As the above description does not constitute a full legal description, said full legal description is annexed to that certain mortgage recorded in the Office of the Camden County Clerk on October 7, 2022 in Book OR-12204 at Page 417 and assigned to Toorak Capital Partners, LLC by assignment recorded April 6, 2023 in Book OR-12326 at Page 1322 and the Writ of Execution on file with the Camden County Clerk. A full legal description can be found in the office of the Clerk of Camden County. EXHIBIT A Legal Description All that certain lot, Piece or parcel of land, with the buildings and improvements thereon erected, situate, lying and being in the Township of Voorhees, in the County of Camden, State of NJ: Beginning at a point of intersection with the Northerly line of Lafayette Avenue and the common line between said Lot 28 and Lot 24 in Block 270 and located North 63 degrees 19 minutes 24 seconds East 200.00 feet from the Northeasterly end of the curve connecting the Northerly line of Lafayette Avenue with the Easterly line of Ninth Avenue the following six courses: 1 . Thence North 26 degrees 40 minutes 36 seconds West 480.00 feet along said common line between said Lot 28 and Lot 24 while continuing by Lots 23 and 22 to a point of intersection with the southerly line of Lippard Avenue; 2. Thence North 63 degrees 19 minutes 36 seconds East 25.00 feet along said Southerly line to a point; 3. Thence North 26 degrees 40 minutes 36 seconds West 25.00 feet to a point in the former centerline of Lippard Avenue; 4. Thence North 63 degrees 19 minutes 24 seconds West 225.00 feet along said former centerline to a point with the former centerline of Eleventh Avenue and common line between said Lot 28 and Lot 66 in Block 270; 5. Thence South 26 degrees 40 minutes 36 seconds East 505.00 feet along said line to a point in the Northerly line of Lafayette Avenue; 6. Thence South 63 degrees 19 minutes 24 seconds West 250.00 feet along said Northerly line of Lafayette Avenue to the point and place of beginning. FOR INFORMATION PURPOSES ONLY: BEING known as 39 Lafayette Ave., Tax Lot 28, Tax Block 270; (f/k/a Tax Lot 2, Tax Block 293) on the Official Tax Map of Township of Voorhees, NJ. Property commonly known as: 39 Lafayette Avenue, Voorhees, NJ 08043 SURPLUS MONEY: If alter the sale and satisfaction of the mortgage debt, including costs and expenses, there remains any surplus money, the money will be deposited into the Superior Court Trust Fund and any person claiming the surplus, or any part thereof, may file a motion pursuant to Court Rules 4:64-3 and 4:57-2 stating the nature and extent of that person's claim and asking for an order directing payment of the surplus money. The Sheriff or other person conducting the sale will have information regarding the surplus, if any. The judgment sought to be satisfied by the sale is: "APPROXIMATELY" $362,019.79 TWENTY PERCENT DEPOSIT REQUIRED Seized as the property of APOLLO EQUITIES LLC, RED BEARD PROPERTIES LLC, AND WELLINGTON FUNDING GROUP, LLC, defendant(s), and taken in execution of TOORAK CAPITAL PARTNERS, LLC, plaintiff GILBERT L. "Whip" WILSON SHERIFF Sheriff's Number: 24000804 DATED: 4/17, 4/24, 5/1, 5/8/2024 Attorney: POLSINELLI PC 600 THIRD AVENUE 42nd FLOOR NEW YORK, NY 10016 Prt’s Fee:$215.04 Affidavit Fee:$5.00

You must Register or Login before you can email ad listings

Listed: Thu May 2nd

NMG Classifieds

Notices Legal Notices

NMG Classifieds

Notices Legal Notices

TOWNSHIP OF HILLSBOROUGH MUNICIPAL UTILITIES AUTHORITY PUBLIC NOTICE BY THE TOWNSHIP OF HILLSBOROUGH MUNICIPAL UTILITIES AUTHORITY OF A PUBLIC HEARING ON A RESOLUTION ESTABLISHING CERTAIN SEWER SERVICE CHARGES AND CONNECTION OR TAPPING FEES PUBLIC NOTICE is hereby given by The Township of Hillsborough Municipal Utilities Authority (hereinafter called the “Authority”) that at 6:00 P. M. prevailing time on the 22nd day of May, 2024, at a meeting of the Authority at the offices of the Authority at 220 Triangle Road, Suite 234, Hillsborough, New Jersey, the Authority will consider the rates, fees, or other charges to be charged to the users of the sewerage services or facilities of the Authority, and that it will consider or may take action and prescribe such charges in accordance with the Municipal Utilities Authorities Law, and TAKE FURTHER NOTICE that at such time and place aforesaid, a Public Hearing will be held by the Authority with respect to such charges at which time all persons interested may appear and will be heard. The following amended resolution will be considered at the time aforesaid. RESOLUTION BY THE TOWNSHIP OF HILLSBOROUGH MUNICIPAL UTILITIES AUTHORITY ESTABLISHING CERTAIN SEWER SERVICE CHARGES AND CONNECTION OR TAPPING FEES WHEREAS, the Township of Hillsborough Municipal Utilities Authority, (hereinafter the “Authority”) is required by law and by Section 303 of its Service Contract with The Township of Hillsborough to promulgate certain uniform charges and connection or tapping fees or charges so that the revenues therefrom will at all times be adequate to pay the expenses of operation and maintenance of the utility system, including reserves, insurance, extensions and replacements, and to pay the principal of and interest on any bonds required by the terms of any contract or the municipal authority or as it may deem necessary or desirable: NOW, THEREFORE, BE IT RESOLVED by The Township of Hillsborough Municipal Utilities Authority that it hereby adopt, prescribe and establish the following amendment to the Resolution Establishing Certain Sewer Service Charges and Connection or Tapping Fees, the same to become effective and commencing at 1:00 A.M. on June 1, 2024. SECTION I. is hereby amended as follows: SECTION I. ANNUAL SERVICE CHARGES A. The annual service charge shall be calculated on the basis that one Equivalent Dwelling Unit (“EDU”) is 300 gallons per day. B. The annual service charge for each “EDU” (300 gallons per day) shall be $480.00. C. The annual service charge shall be calculated for various uses utilizing the flow criteria set forth in Schedule 1 attached hereto. D. The annual service charge for all non-residential uses shall be, as a minimum, one “EDU”, and the user shall be billed $480.00 for each “EDU” or part thereof. E. The annual service charge for facilities with combined uses shall be determined by the summation of all appropriate flow values. F. The annual service charge for all other industrial, research commercial or mixed uses not specifically mentioned in Schedule 1 shall be determined by the following formula: (a factor to be determined by the Authority Engineer taking into Account the excess Biochemical Oxygen Demand (B.O.D.) and Suspended Solids (S.S.) of the Sewerage.) Estimated Daily Flow (gallons) X $480.00 X 300 In utilizing this formula: 1. All analysis shall be in accordance with the current edition of “Standard Methods for the Examination of Water and Wastewater” published by the American Public Health Association, the American Water Works Association and the Water Environment Federation, which methods and definitions are adopted by reference herein. A copy of said edition shall be on file with the Executive Director of the Authority. 2. The estimated daily flow shall be determined by the Authority Engineer according to accepted engineering standards and practices, and this determination shall be filed with the Authority. G. Where the Authority determines that any customer, residential or non-residential, is discharging a combination of sewerage and storm water or drainage or water from any source into the lines of the Authority in excess of the estimated basic standard of 300 gallons per day for an EDU, the Authority shall determine the quantity of such excess and may charge therefor $480.00 per year for each 300 gallons per day or part thereof of such estimate or actual flow which is in excess of the aforesaid basic standard. Such charge shall be in addition to the annual charge to such customer set forth in Schedule 1 hereof and will be added to the billing of such customer for the next quarter following the quarter when such excess has been determined. The estimated average daily flow shall be determined by the Authority on the basis of the factors specified in N.J.S.A. 40:B-22 and such other data and information made available to the Authority from its consulting engineer and the results of its other investigations and studies. Any such determination shall be filed with the Executive Director of the Authority and shall be available for public inspection. The charge may, if the Authority so shall determine, be in the nature of an estimated charge which shall be subject to revision after the installation or construction is completed. In no event shall the connection or tapping fee be reduced from the original charge. As used in the above paragraph, the phrase “estimated average daily flow” shall be based on that consecutive period of three months which had the highest total flow within the first calendar year provided that there is no change in use. THE TOWNSHIP OF HILLSBOROUGH MUNICIPAL UTILITIES AUTHORITY Richard Nunn, Chairman SCHEDULE 1 Type of Establishment Measurement Gallons Per Unit Day Single family residential dwelling dwelling 300 Multiple family residential dwellings including townhouses, condo- miniums and apartments. 1 bedroom unit dwelling 180 2 bedroom unit dwelling 255 3 bedroom unit dwelling 300 Senior (age restricted) housing: 1 bedroom unit dwelling 110 2 bedroom unit dwelling 170 3 bedroom unit dwelling 225 Assisted living facilities * bed 100 Health care facilities: * Hospitals bed 175 Nursing or rehabilitation facilities bed 125 Hotels, Motels* bedroom 75 *The gallons per day for these facilities apply to the beds or bedrooms only. Additional flows will be calculated for kitchens, restaurants, bars, laundries, etc. in accordance with Section I.(D). Restaurants: full service seat 35 bar/cocktail lounges seat 20 fast food seat 15 24 hour service seat 50 curb service/drive-in car space 50 Catering/banquet hall person 20 Schools (includes staff): no shower or cafeteria student 10 with cafeteria student 15 with cafeteria and showers student 20 with cafeteria, showers and laboratory student 25 boarding student 75 Churches (worship area only) seat 3 Clubs: residential member 75 non-residential member 35 tennis, racquetball per court per hour 80 Camps: children’s’ residential bed 50 day camps (no meals) person 15 parked mobile trailer site site 200 campground/mobile recreational vehicle/tent site 100 Firehouses, rescue squad buildings seat 3 Theaters seat 3 Dinner theaters seat 20 Bowling alleys alley 200 Sports Stadiums seat 3 Laundromats machine 300 Automobile service stations filling position 125 with service bays bay 50 with mini-market sq. ft. .100 Stores and shopping centers sq. ft. .100 Office Buildings sq. ft. .100 Factories, warehouses, industry (does not include process wastewater) employee 25 Factories, warehouses, industry with showers (does not include process wastewater) employee 40 1x, HB, 5/3/24, Fee:$143.29 Affidavit Fee:$15.00

You must Register or Login before you can email ad listings

Listed: Sat May 4th

NMG Classifieds

Notices Legal Notices

NMG Classifieds

Notices Legal Notices

TOWNSHIP OF WEST WINDSOR ZONING BOARD OF ADJUSTMENT NOTICE OF HEARING OF APPLICATION In accordance with the requirements of the Township of West Windsor Zoning Ordinance and Section 40:55D-12 of the Revised Statutes of the State of New Jersey, notice is hereby given that an application has been filed by the undersigned with the Secretary of the Zoning Board of Adjustment, and is available for examination. PLEASE TAKE NOT!CE: That the undersigned has filed an application for development with the Zoning Board of Adjustment of the Township of West Windsor for: The continued use of a 65' x 14' meshed netting batting cage. The batting cage is 10' set in from my fenced in property and is surrounded by 12' to 20' Evergreen trees and is not visible to the street/neighbors. on the premises located at 6 Robin Circle. and designated as Block 27.05 Lot (s) 36 on the West Windsor Township Tax Map. A public hearing has been set for June 6th 2024 at 7:00 pm in the West Windsor Township Municipal Building at 271 Clarksville Road (on the corner of Clarksville and North Post Roads) Princeton Junction. New Jersey. Any interested party may appear at the aforesaid hearing, either in person or by their attorney, and be given an opportunity to be heard with respect to the aforesaid application. All documents relating to this application may be inspected by the public Monday through Friday between the hours of 9:00 a.m. and 5:00 p.m. in the office of the Division of Land Use, West Windsor Township Municipal Building at the corner of Clarksville and North Post Roads, Princeton Junction, New Jersey. Elan "Steve" Rome Applicant 1x, PP, 5/3/24, Fee:$28.33. Affidavit Fee:$15.00

You must Register or Login before you can email ad listings

Listed: Sat May 4th

NMG Classifieds

Notices Legal Notices

NMG Classifieds

Notices Legal Notices

Masonry

Miscellaneous

LEGAL NOTICE Order to Show Cause, sought by Plaintiff, Gordon S. Rowe, 61 Genesee Lane, Willingboro, NJ 08046 wherein I am seeking an Order directing the New Jersey Motor Vehicle Commission to issue Certificate of Title to a 1990 Ford Mustang, 1FACP42E5LF134230 in my name. Objection to this application must be sent to the Court at the following address: Burlington County Courthouse, 49 Rancocas Road, Mount Holly, NJ 08060

You must Register or Login before you can email ad listings

Listed: Wed May 1st

NMG Classifieds

Other Services Miscellaneous

NMG Classifieds

Other Services Miscellaneous

Moving and Hauling

APT & SMALL MOVES, Etc Man w/pickup truck. Moving, furn/appl, pickup+ del. clean outs. Call Jack 267-312-5948

You must Register or Login before you can email ad listings

Listed: Thu May 2nd

NMG Classifieds

General Services Moving and Hauling

NMG Classifieds

General Services Moving and Hauling

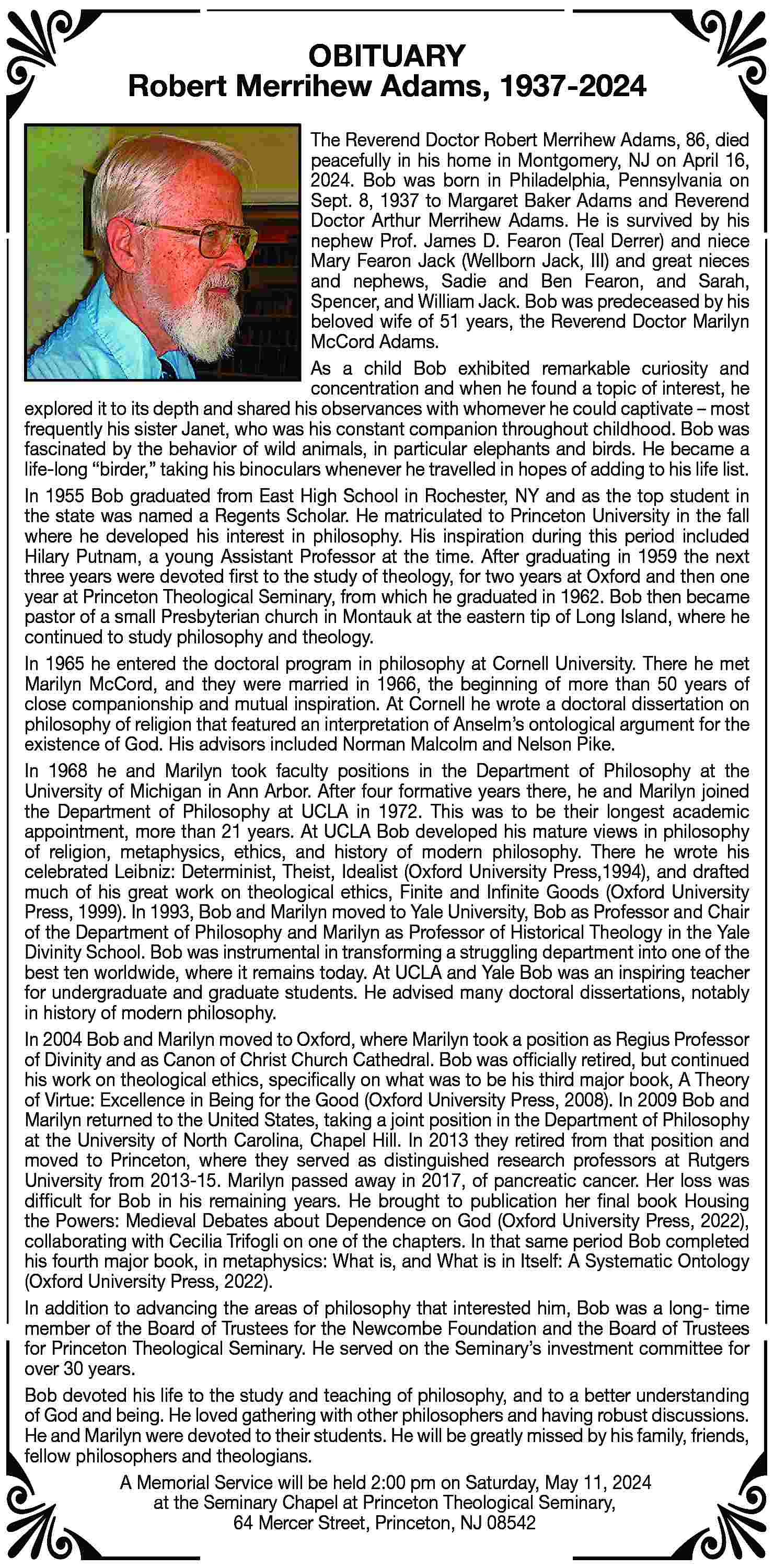

Obituaries

Oil Tanks

Painting

Painting, Drywall, & Misc. Handyman Repairs Exp. Lic., & Ins. Free Est. Call David (267) 333-8502

You must Register or Login before you can email ad listings

Listed: Thu May 2nd

NMG Classifieds

Home

Improvement Painting

NMG Classifieds

Home

Improvement Painting

Plumbing

GOODMAN PLUMBING AIR CONDITION SALES & SERVICE PLUMBING • HEATING • DRAIN CLEANING CEILING LEAKS • HOT WATER HEATERS **CITY VIOLATIONS ** • **EMERGENCY SERVICE** Save $35 with this ad "$25 Drain Cleaning Coupon" (Not to be combined with any other offer) Reg#2665 • PA 051871 215-455-1000 All credit cards accepted Serving Phila for over 50 years

You must Register or Login before you can email ad listings

Listed: Thu May 2nd

NMG Classifieds

Home

Improvement Plumbing

NMG Classifieds

Home

Improvement Plumbing

Power Washing

Prayer Thank You

PRAYER IS POWERFUL Oh, most beautiful flower of Mount Carmel, fruitful vine of splendor of Heaven, Blessed Mother of the son of God, Immaculate Virgin, assist me in my necessity. Oh, Star of the Sea, help me and show me herein you are my Mother. Oh, Holy Mary Mother of God, Queen of Heaven and Earth! I humbly beseech you from the bottom of my heart to succor me in this petition. There are none that can withstand your power. Oh, show me herein you are my Mother. Oh Mary conceived without sin pray for us who have recourse in thee (3Xs). Holy Mother, I place this cause in your hands (3Xs). Holy Spirit, you who solve all problems, light all roads so I can attain my goal. You who gave me the divine gift to forgive and forget all evil against me and that in all instances in my life you are with me, I want in this short prayer to thank you for all things as you confirm once again that I never want to be separated from you in eternal glory. Thank you for your mercy towards me and mine. + Say this prayer 3 consecutive days and publish prayer after petition is granted. Do not despair. Additional advice and petition. Pray the Rosary regularly. F.A.M.

You must Register or Login before you can email ad listings

Listed: Sat May 4th

NMG Classifieds

Notices Prayer Thank You

NMG Classifieds

Notices Prayer Thank You